Save time

Backtesting an investment strategy can be a long and tedious process. The only thing you could lose by backtesting a trading systmem is not money but patience. All current Backtesting softwares in this industry forces the users to move the time forward, step by step. This makes the Backtesting process very time-consuming.

NakedMarkets solves this problem. Our software introduces the concept of Rules, allowing to suspend the Markets under user-defined conditions.

Moreover, the Rules permits the design of full-automated trading strategies, without requiring coding skills. All is done graphically by naturally drag&dropping rules on charts.

This simple concept streamlines the orders creation process, as well, and helps you to save a lot of time.

Define your rules

NakedMarkets embraces the concept of Rule, giving the possibility to define user needs and backtesting workflow.

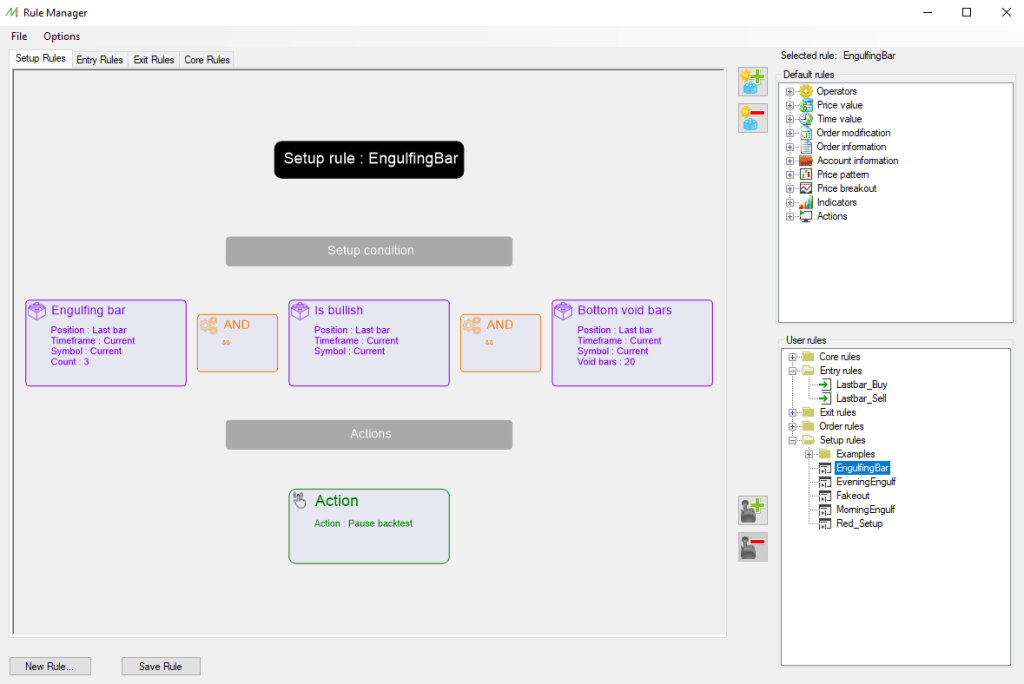

The main module aimed to process theses Rules is the Rule Manager.

The Rule Manager allows the user to define :

- Setup Rules to set an action when a condition is met

- Entry Rules to set an order with the related parameters

- Exit Rules to close orders when a condition is met

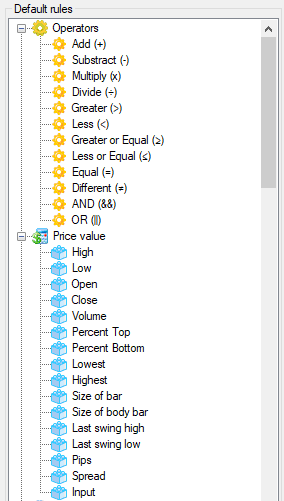

NakedMarkets benefits from Default Rules, helping the user to express their conditions and parameters.

Then, the user can build User Rules by relying on the Default Rules.

Once the Rules are defined, it’s possible to attach them instantly to the current backtesting chart.

No coding skills required

Any rule is set up graphically by drag&dropping Default or User Rules.

There is no need to know any programmation language. The Rule Manager has been designed to be easily handled in order to create conditions in a fluent and accessible way.

The conditions can be trivially expanded with Default Rules or User defined Rules. Thus, the trading system can be simple with few conditional statements or very complex with interlinked Rules.

NakedMarkets provides all the tools to add conditions with boolean Rules. The Default Rules are aimed to provide every Markets informations, as well as account and orders informations, to define specific conditions. Then, the backtest can be paused or an Entry Rule can be set to enter the Markets.

Unlimited possibilities

Besides the Setup, Entry and Exit Rules, it’s possible to define Core Rules.

A Core Rule is a Rule composed by one or several other Rules. This means that NakedMarkets offers the possibility to express conditions related to others conditions in order to elaborate complex systems and organize it appropriately.

The Wiki describes the guidelines behind the concept of Setup, Entry, Exit and Core Rules.

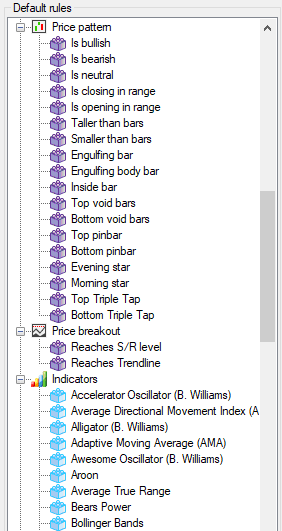

The user defined Rules rely on the default native Rules, installed in NakedMarkets. The Default Rules provide all the information needed :

- Conditional operators : and, or, greater, less, equal, add, substract, …

- Price Market informations : Open/High/Low/Close of bars, spread, size of bars, lowest/highest values…

- Time Market informations : minutes, hours, days, weeks, …

- Order informations : open/close time, open/close price, profit, symbol, …

- Account informations : balance, equity, history trades, …

- Price patterns : Bullish/Bearish bar, Engulfing bar, Inside bar, Evening star, …

- Price breakouts : S/R levels breakout, Trendline breakout, …

- Indicators : value calculated by each indicator

Every Default Rules are described, with the related parameters, in the Wiki.

Moreover, we will be happy to add new Default Rules if you request it.

Semi-automated trading

Save time

- Stop pressing the single step forward button

- Define easily your own Markets conditions

- Pause automatically the Backtest when these conditions are met

- Decide if you enter the Markets or not

Focus on the most important part

You no longer need to spend your time waiting for a particular setup.

You only need to define once and for all the Market state you’re seeking by setting your Setup Rule. Then, wait for the setup to print on the charts.

Hence, you can focus on the most important part of your trading system : the decision process. The ability you have to choose the proper setup will frame the profitability of your trading system.

By defining your own Entry Rule once and for all, you just need to drag&drop it on the chart to enter the Markets, depending on your needs.

Full automated trading

A Setup Rule is able to include one or multiple Actions when the conditions are met. The Actions can be used to :

- Pause the backtest

- Print a message

- Join an Entry Rule

By inserting an Entry Rule, the user can build an entirely automated trading system. Thus, NakedMarkets will set orders when the user defined Markets conditions are satisfied.

The Entry Rules are designed by the user as well. These can rely on other user defined Rules, in order to set dynamic values to the Stop loss, the Take profit and the Entry Price.

Moreover, an Exit Rule can be applied to any Entry Rule, to automatically exit the Markets when needed (ex: Trailing stops, 3 bars exits, …).

This way, a full automated trading system can be built without coding skills, by simply drag&dropping items.

Fast Backtest

Once the Setup, Entry, and potentially Exit, Rules of the trading system have been designed, NakedMarkets gives the possibility to assess them against the Markets, in a easy and fast way.

The Fast Backtest module allows the user to select :

- Any Market symbol

- Any Timeframe

- Any Setup Rules (or API strategies)

Furthermore, it’s possible to choose different Entry and Exit Rules for a same Setup Rule. That lets the user compare different Entry/Exit strategies for a same trading system in a convenient way.

In several seconds, we can obtain the performance of the trading systems and display the detailed statistics of it.