Difference between revisions of "Indicators Rules"

| Line 47: | Line 47: | ||

All returned value are float values. These value depends on the calculations made within the Indicator and can be read on our Github.<br> | |||

However, we added notes for some indicators particularities if needed. If there is no notes, it means that the returned value are the current indicator values. For example, the Ichimoku Tenkan Sen value will return the current Tenkan Sen value displayed by the indicator. | |||

The indicators can have particularities when the buffers are not aimed to be directly displayed as drawing lines or histogram (ie : arrows or sections). | |||

Here is the list of return value of all native indicators under NakedMarkets : | Here is the list of return value of all native indicators under NakedMarkets : | ||

{| class="wikitable" style="border-style: solid; border-width: 2px; width: 1537px; height: 1199px;" cellpadding="10" | {| class="wikitable" style="border-style: solid; border-width: 2px; width: 1537px; height: 1199px;" cellpadding="10" | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

! style="width: 299.767px; height: 28px;" | Indicator name !! style="height: 28px; width: 751.583px;" colspan="5" | Returned values | ! style="width: 299.767px; height: 28px;" | Indicator name !! style="height: 28px; width: 751.583px;" colspan="5" | Returned values | ||

! style="width: 446.65px;" | Notes | ! style="width: 446.65px;" | Notes | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

''' Accelerator Oscillator''' | ''' Accelerator Oscillator''' | ||

| style="width: 112.517px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 112.517px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" >AC1</span> | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 626.8px;" colspan="4" | <span style="color: | | style="height: 28px; text-align: center; vertical-align: middle; width: 626.8px;" colspan="4" | <span style="color: #000000;" >AC2</span> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" ><br></span> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

''' ADX (Average Directional Movement Index)''' | ''' ADX (Average Directional Movement Index)''' | ||

| style="width: 112.517px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 112.517px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" >ADX</span> | ||

| style="width: 116.317px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 116.317px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" >+Di</span> | ||

| style="width: 498.217px; height: 28px; text-align: center; vertical-align: middle;" colspan="3" | <span style="color: | | style="width: 498.217px; height: 28px; text-align: center; vertical-align: middle;" colspan="3" | <span style="color: #000000;" >-Di</span> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" ><br></span> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

''' Alligator ''' | ''' Alligator ''' | ||

| style="width: 112.517px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 112.517px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" >Jaws</span> | ||

| style="width: 116.317px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 116.317px; height: 28px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" >Teeth</span> | ||

| style="width: 498.217px; height: 28px; text-align: center; vertical-align: middle;" colspan="3" | <span style="color: | | style="width: 498.217px; height: 28px; text-align: center; vertical-align: middle;" colspan="3" | <span style="color: #000000;" >Lips</span> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <span style="color: | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <span style="color: #000000;" ><br></span> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

''' AMA (Adaptative Moving Average)''' | ''' AMA (Adaptative Moving Average)''' | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | <span style="color: | | style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | <span style="color: #000000;" >AMA</span><br> | ||

| style="text-align: center; vertical-align: middle; width: 446.65px;" | <span style="color: | | style="text-align: center; vertical-align: middle; width: 446.65px;" | <span style="color: #000000;" ><br></span> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Awesome Oscillator (B. Williams)''' | '''Awesome Oscillator (B. Williams)''' | ||

| Line 89: | Line 90: | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 626.8px;" colspan="4" | SMA2 | | style="height: 28px; text-align: center; vertical-align: middle; width: 626.8px;" colspan="4" | SMA2 | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Aroon''' | '''Aroon''' | ||

| Line 95: | Line 96: | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 626.8px;" colspan="4" | Buffer2 | | style="height: 28px; text-align: center; vertical-align: middle; width: 626.8px;" colspan="4" | Buffer2 | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | '''Average True Range''' | | style="width: 299.767px; height: 28px;" | '''Average True Range''' | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | ATR | | style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | ATR | ||

| style="text-align: center; vertical-align: middle; width: 446.65px;" | <br> | | style="text-align: center; vertical-align: middle; width: 446.65px;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Bears Power''' | '''Bears Power''' | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | Bears Power | | style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | Bears Power | ||

| style="text-align: center; vertical-align: middle; width: 446.65px;" | <br> | | style="text-align: center; vertical-align: middle; width: 446.65px;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Bollinger Bands''' | '''Bollinger Bands''' | ||

| Line 111: | Line 112: | ||

| style="width: 498.217px; height: 28px; text-align: center; vertical-align: middle;" colspan="3" | Down Band | | style="width: 498.217px; height: 28px; text-align: center; vertical-align: middle;" colspan="3" | Down Band | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Bulls Power''' | '''Bulls Power''' | ||

| Line 117: | Line 118: | ||

Bulls Power | Bulls Power | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''CCI (Commodity Channel Index)''' | '''CCI (Commodity Channel Index)''' | ||

| Line 123: | Line 124: | ||

CCI | CCI | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''DeMarker''' | '''DeMarker''' | ||

| Line 129: | Line 130: | ||

DeMarker | DeMarker | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Donchian Channel''' | '''Donchian Channel''' | ||

| Line 137: | Line 138: | ||

| style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | Midline Donchian | | style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | Midline Donchian | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Envelopes''' | '''Envelopes''' | ||

| Line 144: | Line 145: | ||

| style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Envelope Down | | style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Envelope Down | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Fractals''' | '''Fractals''' | ||

| Line 150: | Line 151: | ||

Fractal Up<br> | Fractal Up<br> | ||

| style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Fractal Down | | style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Fractal Down | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | Buffer Type = DrawingStyle.DRAW_ARROW. | ||

|- style="height: 31px;" | |||

The Fractal Up contains the High of the bar where a Fractal is displayed, otherwise it contains Double.NaN if no Fractal is displayed. The Fractal Down contains the Low of the bar where a Fractal is displayed.<br> | |||

|- style="height: 31px;" | |||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''FTLM-STLM''' | '''FTLM-STLM''' | ||

| Line 158: | Line 161: | ||

| style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | STLM | | style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | STLM | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''HMA (Hull Moving Average)''' | '''HMA (Hull Moving Average)''' | ||

| Line 165: | Line 168: | ||

| style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | HMA Down | | style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | HMA Down | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Ichimoku''' | '''Ichimoku''' | ||

| Line 175: | Line 178: | ||

| style="width: 244.467px; text-align: center; vertical-align: middle; height: 31px;" | Senkou Span B<br> | | style="width: 244.467px; text-align: center; vertical-align: middle; height: 31px;" | Senkou Span B<br> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Keltner Channels''' | '''Keltner Channels''' | ||

| Line 183: | Line 186: | ||

| style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | Lower band | | style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | Lower band | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''MACD''' | '''MACD''' | ||

| Line 190: | Line 193: | ||

| style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Signal line | | style="width: 626.8px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Signal line | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''MACD (new version)''' | '''MACD (new version)''' | ||

| Line 198: | Line 201: | ||

| style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | MACD - Signal line | | style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | MACD - Signal line | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''MACD (TV version)''' | '''MACD (TV version)''' | ||

| Line 206: | Line 209: | ||

| style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | Histogram | | style="width: 498.217px; height: 31px; text-align: center; vertical-align: middle;" colspan="3" | Histogram | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Momentum''' | '''Momentum''' | ||

| Line 212: | Line 215: | ||

Momentum | Momentum | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''Moving Average''' | '''Moving Average''' | ||

| Line 218: | Line 221: | ||

Moving Average | Moving Average | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''OBV (On Balance Volume)''' | '''OBV (On Balance Volume)''' | ||

| Line 224: | Line 227: | ||

OBV | OBV | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''PSAR (Parabolic Stop And Reverse)''' | '''PSAR (Parabolic Stop And Reverse)''' | ||

| Line 230: | Line 233: | ||

PSAR | PSAR | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''PCCI (Perfect Commodity Channel Index)''' | '''PCCI (Perfect Commodity Channel Index)''' | ||

| Line 236: | Line 239: | ||

PCCI | PCCI | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''PFE (Polarized Fractal Efficiency)''' | '''PFE (Polarized Fractal Efficiency)''' | ||

| Line 242: | Line 245: | ||

PFE | PFE | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Pivots points''' | '''Pivots points''' | ||

| Line 248: | Line 251: | ||

R3, R2, R1, PP, S1, S2, S3, M1, M2, M3, M4 <br> | R3, R2, R1, PP, S1, S2, S3, M1, M2, M3, M4 <br> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Price channel''' | '''Price channel''' | ||

| Line 255: | Line 258: | ||

| style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | Down Band | | style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | Down Band | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''ROC (Rate Of Change)''' | '''ROC (Rate Of Change)''' | ||

| Line 261: | Line 264: | ||

ROC | ROC | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''RSI (Relative Strength Index)''' | '''RSI (Relative Strength Index)''' | ||

| Line 267: | Line 270: | ||

RSI | RSI | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Solar Wind''' | '''Solar Wind''' | ||

| Line 274: | Line 277: | ||

| style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | Down Buff | | style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | Down Buff | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Stochastic''' | '''Stochastic''' | ||

| Line 281: | Line 284: | ||

| style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | D Line | | style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | D Line | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Support & Resistance''' | '''Support & Resistance''' | ||

| Line 288: | Line 291: | ||

| style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | Support | | style="width: 626.8px; height: 28px; text-align: center; vertical-align: middle;" colspan="4" | Support | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''TDI (Traders Dynamic Index)''' | '''TDI (Traders Dynamic Index)''' | ||

| Line 298: | Line 301: | ||

| style="width: 244.467px; height: 28px; text-align: center; vertical-align: middle;" | Trade Signal Line<br> | | style="width: 244.467px; height: 28px; text-align: center; vertical-align: middle;" | Trade Signal Line<br> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Range Expansions Index''' | '''Range Expansions Index''' | ||

| Line 304: | Line 307: | ||

REI | REI | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Ultimate Oscillator''' | '''Ultimate Oscillator''' | ||

| style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | Ultimate Oscillator<br> | | style="height: 28px; text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | Ultimate Oscillator<br> | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 299.767px; height: 28px;" | | | style="width: 299.767px; height: 28px;" | | ||

'''Volume''' | '''Volume''' | ||

| Line 315: | Line 318: | ||

Volume | Volume | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 299.767px; height: 31px;" | | | style="width: 299.767px; height: 31px;" | | ||

'''%R : Percent Range (B. Williams)''' | '''%R : Percent Range (B. Williams)''' | ||

| Line 325: | Line 328: | ||

'''ZigZag''' | '''ZigZag''' | ||

| style="text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | ZigZag | | style="text-align: center; vertical-align: middle; width: 751.583px;" colspan="5" | ZigZag | ||

| style="width: 446.65px; text-align: center; vertical-align: middle;" | <br> | | style="width: 446.65px; text-align: center; vertical-align: middle;" | Buffer Type = DrawingStyle.DRAW_LINE. | ||

The ZigZag value contains the High or the Low of each line displayed on the chart. If no new line is created, no new highs, or lows, the value contains Double.NaN.<br> | |||

|} | |} | ||

Revision as of 07:13, 8 January 2024

Summary

This Indicators category contains all Default Rules using the Indicators on the Charts.

You can access every Indicator installed in Naked Markets, the default and the custom ones. Thus, every rule in this category is a Value Rule. This means that it returns always a number value and not a condition (True or False).

You can specify which data you want to get from the Indicator

Indicators

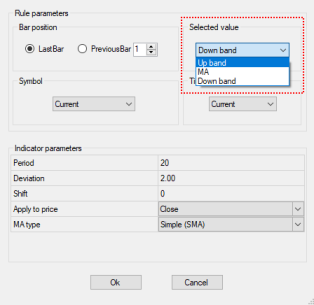

Every Indicator Rules will return the data value defined by the Rule, identified by the "Selected Value" option in the Indicator Parameters form.

Example with the Bollinger Band Indicator :

Common Parameters

- Selected Value : This is the value returned by the Indicator Rule. It depends on the Indicator you want to use. In the Bollinger Band above example, we can select the UpperBand, the MiddleBand or the LowerBand.

- Bar Position : Position of the Bar on the current chart. "0" is the last printed Bar on the chart. "1" is the previous Bar from the last Bar. "2" is the second previous Bar from the last Bar.

- Timeframe : Timeframe of the Bar. It's advised to let the value "Current" to get the value of the Bar on the current chart.

- Symbol : Symbol of the Bar. It's advised to let the value "Current" to get the value of the Bar on the current chart.

Indicator specific Parameters

The list depends on the indicator you use in the Rule. This is the list of parameters you choose when you attach the Indicator on the Chart.

In the previous example with the Bollinger Bands, these are : Period, Deviation, Shift, ...

Indicators return value list

For each indicator included in a rule, the selected return value can be different. As an example, if the use wants to use the Bollinger Bands indicator in his own rules, he can select the value of Up Band, Middle band or Down Band. These values are stored as IndicatorBuffer objects in the NakedMarkets API. These can be reviewed for all indicators on our Github since their source code is public. The return value will appear in the Rule indicator properties form if the indicator has called the SetIndexStyle() and SetIndexLabel() functions.

For information, if an indicator does not have return or calculated values (ie : trading sessions indicator), it will not be displayed in the related category under the Rule Manager.

All returned value are float values. These value depends on the calculations made within the Indicator and can be read on our Github.

However, we added notes for some indicators particularities if needed. If there is no notes, it means that the returned value are the current indicator values. For example, the Ichimoku Tenkan Sen value will return the current Tenkan Sen value displayed by the indicator.

The indicators can have particularities when the buffers are not aimed to be directly displayed as drawing lines or histogram (ie : arrows or sections).

Here is the list of return value of all native indicators under NakedMarkets :

| Indicator name | Returned values | Notes | ||||

|---|---|---|---|---|---|---|

|

Accelerator Oscillator |

AC1 | AC2 | ||||

|

ADX (Average Directional Movement Index) |

ADX | +Di | -Di | |||

|

Alligator |

Jaws | Teeth | Lips | |||

|

AMA (Adaptative Moving Average) |

AMA |

|||||

|

Awesome Oscillator (B. Williams) |

SMA1 |

SMA2 | ||||

|

Aroon |

Buffer1 |

Buffer2 | ||||

| Average True Range | ATR | |||||

|

Bears Power |

Bears Power | |||||

|

Bollinger Bands |

Up Band |

MA | Down Band | |||

|

Bulls Power |

Bulls Power |

|||||

|

CCI (Commodity Channel Index) |

CCI |

|||||

|

DeMarker |

DeMarker |

|||||

|

Donchian Channel |

Upper Donchian |

Lower Donchian |

Midline Donchian | |||

|

Envelopes |

Envelope Up |

Envelope Down | ||||

|

Fractals |

Fractal Up |

Fractal Down | Buffer Type = DrawingStyle.DRAW_ARROW.

The Fractal Up contains the High of the bar where a Fractal is displayed, otherwise it contains Double.NaN if no Fractal is displayed. The Fractal Down contains the Low of the bar where a Fractal is displayed. | |||

|

FTLM-STLM |

FTLM |

STLM | ||||

|

HMA (Hull Moving Average) |

HMA Up |

HMA Down | ||||

|

Ichimoku |

Tenkan Sen |

Kijun Sen |

Chinkou Span |

Senkou Span A |

Senkou Span B |

|

|

Keltner Channels |

Upper band |

Middle band |

Lower band | |||

|

MACD |

MACD |

Signal line | ||||

|

MACD (new version) |

MACD |

Signal line | MACD - Signal line | |||

|

MACD (TV version) |

MACD |

Signal line | Histogram | |||

|

Momentum |

Momentum |

|||||

|

Moving Average |

Moving Average |

|||||

|

OBV (On Balance Volume) |

OBV |

|||||

|

PSAR (Parabolic Stop And Reverse) |

PSAR |

|||||

|

PCCI (Perfect Commodity Channel Index) |

PCCI |

|||||

|

PFE (Polarized Fractal Efficiency) |

PFE |

|||||

|

Pivots points |

R3, R2, R1, PP, S1, S2, S3, M1, M2, M3, M4 |

|||||

|

Price channel |

Up Band |

Down Band | ||||

|

ROC (Rate Of Change) |

ROC |

|||||

|

RSI (Relative Strength Index) |

RSI |

|||||

|

Solar Wind |

Up Buff |

Down Buff | ||||

|

Stochastic |

K Line |

D Line | ||||

|

Support & Resistance |

Resistance |

Support | ||||

|

TDI (Traders Dynamic Index) |

VB High |

Market Base Line |

VB Low |

RSI Price Line |

Trade Signal Line |

|

|

Range Expansions Index |

REI |

|||||

|

Ultimate Oscillator |

Ultimate Oscillator |

|||||

|

Volume |

Volume |

|||||

|

%R : Percent Range (B. Williams) |

%R |

|||||

|

ZigZag |

ZigZag | Buffer Type = DrawingStyle.DRAW_LINE.

The ZigZag value contains the High or the Low of each line displayed on the chart. If no new line is created, no new highs, or lows, the value contains Double.NaN. | ||||