Difference between revisions of "Indicators Rules"

| Line 99: | Line 99: | ||

'''Bulls Power''' | '''Bulls Power''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

Bulls Power | |||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

'''CCI (Commodity Channel Index)''' | '''CCI (Commodity Channel Index)''' | ||

| style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | ||

CCI | |||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

| Line 119: | Line 119: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

Envelopes | '''Envelopes''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

Envelope Up<br> | Envelope Up<br> | ||

| Line 125: | Line 125: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

Fractals | '''Fractals''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

Fractal Up<br> | Fractal Up<br> | ||

| Line 131: | Line 131: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

FTLM-STLM | '''FTLM-STLM''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

FTLM | FTLM | ||

| Line 137: | Line 137: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

HMA (Hull Moving Average) | '''HMA (Hull Moving Average)''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

HMA Up<br> | HMA Up<br> | ||

| Line 143: | Line 143: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

Ichimoku | '''Ichimoku''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

Tenkan Sen<br> | Tenkan Sen<br> | ||

| Line 152: | Line 152: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

Keltner Channels | '''Keltner Channels''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

Upper band<br> | Upper band<br> | ||

| Line 159: | Line 159: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

'''MACD''' | |||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | |||

MACD | MACD | ||

| style="width: 733.2px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Signal line | | style="width: 733.2px; height: 31px; text-align: center; vertical-align: middle;" colspan="4" | Signal line | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

MACD (new version) | '''MACD (new version)''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

MACD | MACD | ||

| Line 172: | Line 172: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

MACD (TV version) | '''MACD (TV version)''' | ||

| style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 31px; text-align: center; vertical-align: middle;" | | ||

MACD | MACD | ||

| Line 179: | Line 179: | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

Momentum | '''Momentum''' | ||

| style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | ||

Momentum | Momentum | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

Moving Average | '''Moving Average''' | ||

| style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | ||

Moving Average | Moving Average | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

OBV (On Balance Volume) | '''OBV (On Balance Volume)''' | ||

| style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | ||

OBV | OBV | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

PSAR (Parabolic Stop And Reverse) | '''PSAR (Parabolic Stop And Reverse)''' | ||

| style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | ||

PSAR | PSAR | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

PCCI (Perfect Commodity Channel Index) | '''PCCI (Perfect Commodity Channel Index)''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

PCCI | PCCI | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

PFE (Polarized Fractal Efficiency) | '''PFE (Polarized Fractal Efficiency)''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

PFE | PFE | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Pivots points | '''Pivots points''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

R3, R2, R1, PP, S1, S2, S3, M1, M2, M3, M4 <br> | R3, R2, R1, PP, S1, S2, S3, M1, M2, M3, M4 <br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Price channel | '''Price channel''' | ||

| style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | ||

Up Band | Up Band | ||

| Line 220: | Line 220: | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

ROC (Rate Of Change) | '''ROC (Rate Of Change)''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

ROC | ROC | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

RSI (Relative Strength Index) | '''RSI (Relative Strength Index)''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

RSI | RSI | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Solar Wind | '''Solar Wind''' | ||

| style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | ||

Up Buff<br> | Up Buff<br> | ||

| Line 236: | Line 236: | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Stochastic | '''Stochastic''' | ||

| style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | ||

K Line<br> | K Line<br> | ||

| Line 242: | Line 242: | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Support & Resistance | '''Support & Resistance''' | ||

| style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | ||

Resistance<br> | Resistance<br> | ||

| Line 248: | Line 248: | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

TDI (Traders Dynamic Index) | '''TDI (Traders Dynamic Index)''' | ||

| style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | | style="width: 72.15px; height: 28px; text-align: center; vertical-align: middle;" | | ||

VB High<br> | VB High<br> | ||

| Line 257: | Line 257: | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Range Expansions Index | '''Range Expansions Index''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

REI | REI | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Ultimate Oscillator | '''Ultimate Oscillator''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | Ultimate Oscillator<br> | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | Ultimate Oscillator<br> | ||

|- style="height: 28px;" | |- style="height: 28px;" | ||

| style="width: 333.65px; height: 28px;" | | | style="width: 333.65px; height: 28px;" | | ||

Volume | '''Volume''' | ||

| style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 28px; text-align: center; vertical-align: middle;" colspan="5" | | ||

Volume | Volume | ||

|- style="height: 31px;" | |- style="height: 31px;" | ||

| style="width: 333.65px; height: 31px;" | | | style="width: 333.65px; height: 31px;" | | ||

%R : Percent Range (B. Williams) | '''%R : Percent Range (B. Williams)''' | ||

| style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | | style="width: 817.617px; height: 31px; text-align: center; vertical-align: middle;" colspan="5" | | ||

%R | %R | ||

|- | |- | ||

| style="width: 333.65px;" | | | style="width: 333.65px;" | | ||

ZigZag | '''ZigZag''' | ||

| style="width: 72.15px; text-align: center; vertical-align: middle;" colspan="5" | ZigZag | | style="width: 72.15px; text-align: center; vertical-align: middle;" colspan="5" | ZigZag | ||

|} | |} | ||

<br> | <br> | ||

Revision as of 06:21, 8 January 2024

Summary

This Indicators category contains all Default Rules using the Indicators on the Charts.

You can access every Indicator installed in Naked Markets, the default and the custom ones. Thus, every rule in this category is a Value Rule. This means that it returns always a number value and not a condition (True or False).

You can specify which data you want to get from the Indicator

Indicators

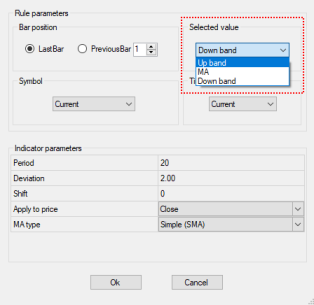

Every Indicator Rules will return the data value defined by the Rule, identified by the "Selected Value" option in the Indicator Parameters form.

Example with the Bollinger Band Indicator :

Common Parameters

- Selected Value : This is the value returned by the Indicator Rule. It depends on the Indicator you want to use. In the Bollinger Band above example, we can select the UpperBand, the MiddleBand or the LowerBand.

- Bar Position : Position of the Bar on the current chart. "0" is the last printed Bar on the chart. "1" is the previous Bar from the last Bar. "2" is the second previous Bar from the last Bar.

- Timeframe : Timeframe of the Bar. It's advised to let the value "Current" to get the value of the Bar on the current chart.

- Symbol : Symbol of the Bar. It's advised to let the value "Current" to get the value of the Bar on the current chart.

Indicator specific Parameters

The list depends on the indicator you use in the Rule. This is the list of parameters you choose when you attach the Indicator on the Chart.

In the previous example with the Bollinger Bands, these are : Period, Deviation, Shift, ...

Indicators return value list

For each indicator included in a rule, the selected return value can be different. As an example, if the use wants to use the Bollinger Bands indicator in his own rules, he can select the value of Up Band, Middle band or Down Band. These values are stored as IndicatorBuffer objects in the NakedMarkets API. These can be reviewed for all indicators on our Github since their source code is public. The return value will appear in the Rule indicator properties form if the indicator has called the SetIndexStyle() and SetIndexLabel() functions.

For information, if an indicator does not have return or calculated values (ie : trading sessions indicator), it will not be displayed in the related category under the Rule Manager.

Here is the list of return value of all native indicators under NakedMarkets :

| Indicator name | Returned values | ||||

|---|---|---|---|---|---|

|

Accelerator Oscillator |

AC1 | AC2 | |||

|

ADX (Average Directional Movement Index) |

ADX | +Di | -Di | ||

|

Alligator |

Jaws | Teeth | Lips | ||

|

AMA (Adaptative Moving Average) |

AMA | ||||

|

Awesome Oscillator (B. Williams) |

SMA1 |

SMA2 | |||

|

Aroon |

Buffer1 |

Buffer2 | |||

| Average True Range | ATR | ||||

|

Bears Power |

Bears Power | ||||

|

Bollinger Bands |

Up Band |

MA | Down Band | ||

|

Bulls Power |

Bulls Power | ||||

|

CCI (Commodity Channel Index) |

CCI | ||||

|

DeMarker |

DeMarker | ||||

|

Donchian Channel |

Upper Donchian |

Lower Donchian |

Midline Donchian | ||

|

Envelopes |

Envelope Up |

Envelope Down | |||

|

Fractals |

Fractal Up |

Fractal Down | |||

|

FTLM-STLM |

FTLM |

STLM | |||

|

HMA (Hull Moving Average) |

HMA Up |

HMA Down | |||

|

Ichimoku |

Tenkan Sen |

Kijun Sen |

Chinkou Span |

Senkou Span A |

Senkou Span B |

|

Keltner Channels |

Upper band |

Middle band |

Lower band | ||

|

MACD |

MACD |

Signal line | |||

|

MACD (new version) |

MACD |

Signal line | MACD - Signal line | ||

|

MACD (TV version) |

MACD |

Signal line | Histogram | ||

|

Momentum |

Momentum | ||||

|

Moving Average |

Moving Average | ||||

|

OBV (On Balance Volume) |

OBV | ||||

|

PSAR (Parabolic Stop And Reverse) |

PSAR | ||||

|

PCCI (Perfect Commodity Channel Index) |

PCCI | ||||

|

PFE (Polarized Fractal Efficiency) |

PFE | ||||

|

Pivots points |

R3, R2, R1, PP, S1, S2, S3, M1, M2, M3, M4 | ||||

|

Price channel |

Up Band |

Down Band | |||

|

ROC (Rate Of Change) |

ROC | ||||

|

RSI (Relative Strength Index) |

RSI | ||||

|

Solar Wind |

Up Buff |

Down Buff | |||

|

Stochastic |

K Line |

D Line | |||

|

Support & Resistance |

Resistance |

Support | |||

|

TDI (Traders Dynamic Index) |

VB High |

Market Base Line |

VB Low |

RSI Price Line |

Trade Signal Line |

|

Range Expansions Index |

REI | ||||

|

Ultimate Oscillator |

Ultimate Oscillator | ||||

|

Volume |

Volume | ||||

|

%R : Percent Range (B. Williams) |

%R | ||||

|

ZigZag |

ZigZag | ||||